Shop Smart and Secure This Holiday Season!

Christmas is just around the corner, and while you might have all your shopping done already, most of us are still looking around for the perfect gift! And like many people, you’ll do a good portion (or even all) of your shopping online.

However, is your financial data protected? Have you taken the proper measures to make sure your online purchases are protected? Finding the perfect gift may be stressful, but cybersecurity doesn’t have to be too—here are a few tips for staying safe while shopping online:

#1: Create Secure Passwords

-

- Checking out online can be a tedious process. You often have to sign-up for an account, fill out your name and shipping information, and choose a username and password to log in to your account.

A crucial part of this process is making sure you choose a secure password. While choosing a password you’ve already memorized is often the easiest route, it is not the safest way to do things. If a cybercriminal breaches an online vendor and gains access to your username and password, they will test those login credentials against more sensitive websites, like you bank or credit card.

The best way to prevent this is to use a different password for every website. This can quickly become overwhelming—to manage all those passwords, we highly recommend our favorite password management tool: LastPass.

#2: Shop on a Secure Website

-

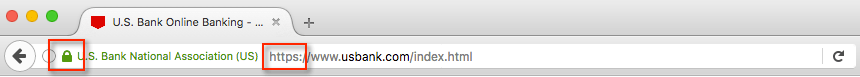

- Shopping on websites through a secure HTTPS connection is one of the most important things you can do to stay safe during the holiday season. A website with HTTPS enabled means that any information you submit will be encrypted rather than being sent over the network in plain text. This helps keep you protected from cybercriminals intercepting and stealing your credit card data.

One way to tell if a website is secure is to look for a padlock icon to the left of the website address in the navigation bar, and “https” at the beginning of the web address. Most common web browsers, including Chrome, Firefox, and Safari, will display this icon.

You can learn more about secure HTTPS connections here.

#3: Avoid Shopping on Public Wi-Fi Networks

-

- Public wi-fi networks are convenient, allowing you to browse the internet for free while on the go. However, public wi-fi networks are rarely secure, and purchasing gifts or logging into online accounts while connected to one can be a huge risk. Any data sent through a free public connection is vulnerable to being observed and captured by malicious cybercriminals.

If you’d like to learn more about some best practices for browsing on public wi-fi networks, don’t miss our One-Minute Wednesday episode on wi-fi security!

#4: Just Say No to Unsolicited Email Offers

-

- Getting deep discounts on your purchases is always exciting, but you should be wary of any email offers coming from stores you don’t commonly shop with. This is a big red flag that could indicate a phishing attempt.

Scammers often send out emails posing as online shopping outlets, tempting consumers to click on malicious links with “can’t-miss” deals and offers. Clicking on these links will allow cybercriminals to steal any information you submit, including usernames and passwords as well as credit card data. If you’ve received a suspicious email like this and have clicked on the link, close the window and type in the online store’s web address directly, just in case.

To learn more about phishing scams and how to spot them, check out our One-Minute Wednesday episode covering the Target Data Breach.

#5: Use a Credit Card, Not a Debit Card

-

- Even if you follow all the best practices outlined above, there’s always a small chance that your financial data will be compromised. Because of this, it’s a smart idea to use a credit card rather than a debit card for online purchases, since most credit cards are covered with fraud protection and credit card companies are incentivized to resolve any fraudulent activity quickly.

Fraudulent activity on your credit card is also better for you because there’s no immediate impact to your cash flow—if someone steals $1000 from your checking account, you’re out of luck until you get it back. But if someone charges up $1000 on your credit card, you aren’t obligated to pay off the charges while you wait for them to be reversed.

Above all, Christmas is a time to celebrate and enjoy your loved ones. Avoid having to worry about your cybersecurity and privacy during the holiday season by following our tips and tricks above.